TradeBot Whitepaper

Introduction

TradeBot ($TRADEBOT) is a community-owned memecoin on the Solana blockchain, designed to protect holders from market dumps through its innovative self-healing technology. This whitepaper explores the current culture of memecoins, the application of the Greater Fool theory, and the broader ramifications for investors. We introduce TradeBot's self-healing technology, which aims to safeguard holders and strengthen the Solana community. By examining a case study of the $BRETT token, we will demonstrate how TradeBot stabilizes token prices and benefits holders, encouraging new investors to join the TradeBot and Solana communities.

Current Culture of Memecoins

Memecoins have become a distinctive segment within the cryptocurrency market, often viewed as gambling tools that can yield either substantial gains or significant losses. These coins are driven purely by the popularity of their associated memes or logos, with no inherent utility.

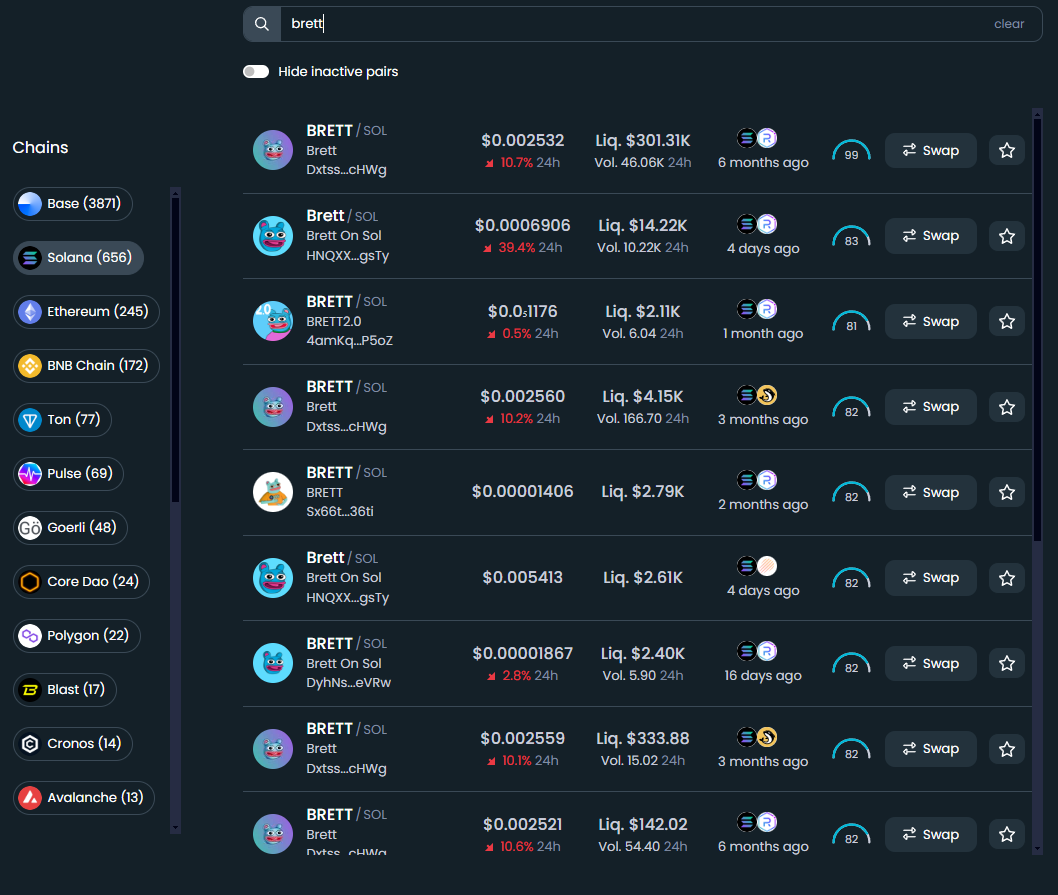

The proliferation of memecoins is evident, as illustrated by the existence of many different $BRETT tokens. $BRETT, inspired by Brett, a friend of the popular meme character PEPE the Frog, is an example of how memecoins capitalize on well-known internet memes. A search for BRETT returned over 5000 results spanning across multiple blockchains. For example, there are 3871 $BRETT tokens on the BASE blockchain, 656 $BRETT tokens on the Solana blockchain, and 245 $BRETT tokens on the Ethereum blockchain. This ease of duplication contributes to a culture of mistrust and paranoia among investors as token creators can easily abandon a project in order to create another token.

Developer 'rug pulls,' where token creators suddenly sell off their holdings, often leave investors scrambling to recover their losses. The impact can be particularly devastating. For example, in the case of $BRETT, 63.8% of all traders were negatively impacted.

Investors who didn't sell early were left 'holding their bags,' enduring significant losses in the value of their holdings. Such scenarios are all too common in the world of memecoins, leading to a general consensus that the best strategy is to get in and out quickly. Our upcoming case study reveals that the majority of $BRETT holders had an average hold time of less than a day, highlighting the speculative and fleeting nature of memecoin investments.

Application of the Greater Fool Theory

The Greater Fool theory, which suggests that an investment's success relies on finding a "greater fool" to purchase the asset at a higher price, is particularly relevant to memecoins. Memecoins utilize Liquidity Pools (LP) to facilitate seamless transactions. A Liquidity Pool can be viewed as a vending machine that allows a trader to swap one token for another. The Liquidity Pool uses a mathematical formula to determine the swap rate so that one coin is never fully depleted. When a person buys a memecoin from the Liquidity Pool, the price goes up. Conversely, when a person sells their memecoin to the Liquidity Pool, the price goes down.

When a memecoin is sold, the LP is depleted of the token that provides intrinsic value (Solana, in our case). This necessitates that new buyers replenish the pool. These new buyers could be considered "the greater fools".

This zero-sum game ensures that every winner corresponds to a loser. Our case study of the $BRETT token will demonstrate this dynamic, with charts showing the disparity between winners and losers among token holders.

Case Study: $BRETT Token

To better understand the dynamics and challenges of memecoins, we will look at a case study: the $BRETT token. This case study illustrates the initial surge in price followed by significant sell-offs and the impact on holders.

Brett On Sol (ticker: $BRETT)

- Contract Address: DyhNsutzHbMojnVYyuPZkiQG1HtYoHvKNnAgNrXFeVRw

- DexTools Explorer:Link

- Total Supply: 100,000,000

- Total Unique Traders: 1,831

- Total Transactions: 5,809

- Total Tokens Traded: 1,424,081,552 $BRETT

- Trading Period: June 7, 2024, 19:07:48 to June 26, 2024, 08:03:24

Initial Surge and Sell-Off

The $BRETT token experienced an initial price surge driven by speculative buying. On June 7th, 2024 at 8:00 PM UTC, the price of $BRETT opened at $0.00023889. Within a couple of hours, it shot up to $0.00242581 in a flurry of activity. Sellers started taking profits and the price over a 2.5-week period fell to $0.00001919. These prices led to significant gains and significant losses.

Similar to the game of musical chairs, traders have to buy early and then strategically determine when to sell. This game of cat and mouse is highly risky but lucrative. Analyzing the wallets of all traders who participated, the following was found: 646 traders sold for a loss. 549 traders sold for a profit and exited. A whopping 524 traders are "bag-holders" as they did not sell their coin, and currently have a portfolio value that is negative. 112 traders have holdings that still have a net positive value. Out of the 1831 unique traders, 1170 traders sold for a loss or are in the red. This is 63.8% of all holders. With these odds, an inexperienced investor has better chances with a coin flip.

Taking a look at the distribution of portfolio values, there is a small number of big winners, with the rest fighting for minimal gains. The big winners purchased early or had a zero cost-basis as insiders, further driving cynicism, paranoia, and mistrust within the community. Over half of all traders were negatively impacted. 1018 traders ended with a net value between -$100 and $0.

Self-Healing Technology

TradeBot introduces self-healing technology through a buyback approach, leveraging consistent revenue streams to purchase tokens. This process serves two primary purposes:

- Increase in Token Price: Regular token purchases increase demand, driving up the price.

- Fueling Community Wallets: The Dev, Operations, and Marketing wallet will continuously be filled with $TRADEBOT. This supports OTC sales, airdrops, and marketing campaigns for community growth.

Our community is actively developing multiple revenue streams to support this self-healing mechanism, including a software development company, a trading engine, and a gaming platform. The trading engine, which is already operational, trades against major cryptocurrencies and generates monthly returns between 1% and 16%. These profits are used to buy $TRADEBOT tokens, ensuring a consistent revenue stream to support the token's value.

Simulated Liquidity Pool with Self-Healing Technology

We simulated the $BRETT token transactions under a scenario where a consistent daily revenue stream is used to buy tokens. This simulation demonstrates the positive impact of self-healing technology on token price stability:

$0 BuyBack using Simulated Liquidity Pool

To ensure the highest degree of accuracy, real-world transactions were processed against our simulated Liquidity Pool until our simulated transactions matched the real-world transactions. In this case, we followed K = x * y logic as provided by UniSwap documentation and we used a fee of 0.25%. Using this configuration we were able to replicate the real-world transactions of $BRETT. Compare this chart with the chart above. They match but were generated from two different sources.

- Total $BRETT Purchased: 0

- End Date: 2024-06-26

- Closing Price: $0.00001919

- 1,000,000 $BRETT: $19.19

$10 Daily Buyback using Simulated Liquidity Pool

The buys start on 2024-06-26 at 10 AM. The chart shows a gradual and steady price increase over five months.

- Total $BRETT Purchased: 36,830,108

- End Date: 2024-12-06

- Closing Price: $0.00010262

- 1,000,000 $BRETT: $102.62

$100 Daily Buyback using Simulated Liquidity Pool

A more pronounced price increase is observed, mitigating sell-off impacts. By October 26th, 2024, the ATH price of $0.00242581 is breached, ensuring all holders are in the green. The number of days between the previous high on June 7th, 2024, and October 26th, 2024 is 141 days.

- Total $BRETT Purchased: 60,314,806

- End Date: 2024-12-06

- Closing Price: $0.00380951

- 1,000,000 $BRETT: $3,809.51

$1000 Daily Buyback using Simulated Liquidity Pool

The goal for all of our cumulative efforts. A significant upward price trend over six months highlights the effectiveness of substantial daily investments.

- Total $BRETT Purchased: 64,436,896

- End Date: 2024-12-06

- Closing Price: $0.33231106

- 1,000,000 $BRETT: $332,311.06

$TRADEBOT Case Study

In this case study, we will analyze the historical prices of TradeBot and present projections for different buyback rates using TradeBot's ($TRADEBOT) innovative Self-Healing Technology. These projections are based solely on the daily buyback mechanism, excluding the influence of new traders entering the market, existing traders exiting, or marketing efforts. This baseline scenario showcases the potential for price stabilization and growth driven purely by the Self-Healing Technology.

Analysis of TradeBot Data

The provided TradeBot transaction data includes various parameters such as token amounts, currency amounts, prices, and liquidity pool details. One interesting observation from the data is the steady increase in the price of $TRADEBOT in USD and its corresponding price in SOL. For example, the price per token starts at $0.000048 and gradually increases through subsequent transactions. This indicates a consistent demand for $TRADEBOT, contributing to its price appreciation. Additionally, the liquidity pool reflects growing participation, with significant token amounts being added and traded, which is a positive indicator of market activity and investor confidence.

The average price of $TRADEBOT for the month of May 2024 was approximately $0.0008923, while for June 2024, it increased to about $0.0009939. These monthly averages show a slight upward trend in price, indicating a stable demand and gradual appreciation. However, as we will see, the price of $TRADEBOT outgrew the buyback rate of its Self-Healing technology.

Timeline of Events

May 22nd, 2024 - CoinMarketCap Listing: Notably, on May 22, 2024, TradeBot was approved for listing on CoinMarketCap. CoinMarketCap boasts 30 million impressions per month. Upon our listing, this led to a flurry of activity from sniper bots, which increased the price to its all-time high (ATH). The subsequent sell-off was quick.

May 24th, 2024 - First Major Seller: On May 24, 2024, we had our first major seller, one of the original buyers during the pump.fun incubation period.

May 30th, 2024 - Airdrop Campaign: On May 30, 2024, TradeBot launched a significant airdrop campaign, distributing 5000 $TRADEBOT tokens to each of over 800 wallets. This initiative was driven by the requirement to have at least 500 holders for VERIFIED listing on JupiterSwap. This event marked our first encounter with airdrop farmers who attempted to manipulate the system by claiming multiple allotments. Consequently, the selling pressure surged as the majority of airdrop recipients quickly sold their tokens.

May 31st, 2024 - MEV Bot Incident: On May 31, 2024, at 20:00:00, a sudden price spike occurred due to an MEV (Maximal Extractable Value) bot. These bots detect purchase transactions and front-run them by paying higher gas fees to execute their transactions first. In this incident, the MEV bot bought tokens before the intended buyer, causing a temporary price surge. The buyer then purchased at the inflated price, and the bot immediately sold its tokens for a profit, all within the same block. This manipulation resulted in a false spike in the price. To prevent such occurrences, reducing the slippage setting when purchasing tokens can be effective.

June 14th, 2024 - Seller Cash-Out: June 14, 2024, saw another selloff as three big investors cashed out. The price stabilized and slowly started to heal. In the month of June, the average buyback rate was $20.30. As will be shown, it did have an impact on the price, albeit minor.

June 29th, 2024 - Marketing Blitz: TradeBot was listed on SolTrending and had 100,000 banner impressions on the DexScreener website. Price increased approximately 20% and our Telegram channel doubled in size from ~160 to ~360 members. The rise in price during this 24-hour period can be attributed to marketing.

$TRADEBOT Projections with Self-Healing Technology

The ATH Price and the Simulation Start Price provide a baseline for evaluating the impact of different daily buyback rates. The projected prices for each buyback rate scenario demonstrate that higher buyback rates lead to significantly higher token prices, far exceeding the ATH observed in the real data. This analysis highlights the potential of TradeBot's Self-Healing Technology to create substantial value for token holders through sustained buyback practices. The data shows that even a modest daily buyback rate can lead to noticeable price increases, while higher buyback rates can dramatically enhance the token's value by adding more Solana to the Liquidity Pool.

Assumptions

- Daily Buyback: A consistent amount of $TRADEBOT is bought each day.

- No New Traders: We assume no new traders are entering the market.

- No Current Traders Exiting: We assume that current holders do not sell their holdings.

- Market Conditions: During the simulation, Solana pricing stays consistent at 138.8559.

- No Catastrophic Failures: Volatility drives the trading engine and thus the healing process, but catastrophic failures of BTC, SOL, or USDC would break it.

Simulation Parameters

- Real Data: The simulation uses real transaction data up to 2024-06-30T02:38:07Z.

- Simulation Start: The simulation starts from 2024-07-01.

- Supply At Simulation Start: 998,750,100.332763 $TRADEBOT

- Price At Simulation Start: $0.0008955

- Daily Buyback Amounts: $20, $100, $500, $1000, $10000

- Chart Duration: 1 year (365 days)

- Simulation Duration: July 1st 2024 - April 30th 2025 (303 days)

- Liquidity Pool Settings At Simulation Start:

- 326.835552840 SOL

- 50,795,702.988853 $TRADEBOT

- SOL Amount (USD): 326.835552840 * 138.8559 ≈ $45,383.044

- 1,000,000 $TRADEBOT: $895.50

Projection Analysis

In this section, we aim to evaluate the impact of TradeBot's Self-Healing Technology at various daily buyback rates. By simulating different daily buy amounts—$20, $100, $500, $1000, and $10000—we can observe how each rate influences the price and supply dynamics of $TRADEBOT over a year. This analysis helps illustrate the potential effectiveness of the Self-Healing Technology in different scenarios.

It is important to note that in a real-world scenario, the daily buyback amount would be best represented as an average across time. This approach provides a more realistic view of how the Self-Healing Technology functions under typical market conditions.

$20 TradeBot Buyback Rate

At a $20 daily buyback rate, the price of $TRADEBOT is projected to reach $0.00115088 by 2025-04-30. This minor price increase does not significantly enhance investor value over time. Interestingly, this rate closely matches the average daily buyback rate of $20.30 observed in June 2024. June was a slow month due to market conditions. If this rate continues, for $TRADEBOT to grow substantially, consistent buyback rates must be coupled with effective marketing and community outreach.

- Liquidity Pool Status:

- 370.621951768 SOL

- 44,808,293.694979 $TRADEBOT

- SOL Amount (USD): 370.621951768 * 138.8559 ≈ $51,492.087

- Total $TRADEBOT Purchased: 5,987,409

- Percentage of Total Supply Purchased: 0.5987%

- End Date: 2025-04-30

- Closing Price: $0.00115088

- 1,000,000 $TRADEBOT: $1,150.88

$100 TradeBot Buyback Rate

With a $100 daily buyback rate, the price increases to $0.00249097 by 2025-04-30. This is significantly better than the $20 buyback rate with the price breaching the previous ATH price of $.00201724 on Feb. 14th 2025. By the end of this period, all wallet holders are in the green.

- Liquidity Pool Status:

- 545.767548696 SOL

- 30,457,323.659142 $TRADEBOT

- SOL Amount (USD): 545.767548696 * 138.8559 ≈ $75,783.044

- Total $TRADEBOT Purchased: 20,338,379

- Percentage of Total Supply Purchased: 2.0338%

- End Date: 2025-04-30

- Closing Price: $0.00249097

- 1,000,000 $TRADEBOT: $2,490.97

$500 TradeBot Buyback Rate

A $500 daily buyback rate results in a closing price of $0.01683856, demonstrating significant price appreciation. Traders who bought at the previous all-time high (ATH) of $0.00201724 would enjoy an impressive ROI of 734%. Those who purchased at the simulation start price of $0.0008955 would see an extraordinary ROI of 1780%. Breaking the $0.01 price barrier is also a notable psychological milestone.

- Liquidity Pool Status:

- 1,421.495533336 SOL

- 11,721,006.875546 $TRADEBOT

- SOL Amount (USD): 1,421.495533336 * 138.8559 ≈ $197,383.041

- Total $TRADEBOT Purchased: 39,074,696

- Percentage of Total Supply Purchased: 3.9075%

- End Date: 2025-04-30

- Closing Price: $0.01683856

- 1,000,000 $TRADEBOT: $16,838.56

$1000 TradeBot Buyback Rate

At a $1000 daily buyback rate, the price of $TRADEBOT soars to $0.05266788 by the end of the simulation. During this period, 44,164,798.577405 $TRADEBOT tokens were Purchased, amounting to approximately 4.4165% of the initial supply. The liquidity pool ends with 2,516.155514136 SOL and 6,630,904.411448 $TRADEBOT, showing a dramatic decrease in supply and a corresponding increase in price. Traders who bought at the previous all-time high (ATH) of $0.00201724 would enjoy a hefty ROI of 2510%. Those who purchased at the simulation start price of $0.0008955 would see an incredible ROI of 5781%!

- Liquidity Pool Status:

- 2,516.155514136 SOL

- 6,630,904.411448 $TRADEBOT

- SOL Amount (USD): 2,516.155514136 * 138.8559 ≈ $349,348.429

- Total $TRADEBOT Purchased: 44,164,798

- Percentage of Total Supply Purchased: 4.4165%

- End Date: 2025-04-30

- Closing Price: $0.05266788

- 1,000,000 $TRADEBOT: $52,667.88

$10000 TradeBot Buyback Rate

The $10000 daily buyback rate scenario projects an astonishing price of $4.08494478 by 2025-04-30. During the simulation period, 50,041,002.540019 $TRADEBOT tokens were Purchased, representing 5.0041% of the initial supply. The liquidity pool contains 22,220.035168536 SOL and 754,700.448834 $TRADEBOT. This aggressive buyback rate drastically reduces the token supply, driving the price to unprecedented levels. Traders who bought at the previous all-time high (ATH) of $0.00201724 would experience a staggering ROI of 202,401%, while those who purchased at the simulation start price of $0.0008955 would see an extraordinary ROI of 456,063%. However, there is a liquidity issue. At this price point, a theoretical holder of 1,000,000 $TRADEBOT has a value greater than the total Solana in the liquidity pool. To address this, the community would need to add liquidity, or the holder would need to sell small amounts periodically over time to allow other traders to replenish the SOL supply. In this manner, the theoretical investor could obtain their total value with minimal slippage.

- Liquidity Pool Status:

- 22,220.035168536 SOL

- 754,700.448834 $TRADEBOT

- SOL Amount (USD): 22,220.035168536 * 138.8559 ≈ $3,085,382.981

- Total $TRADEBOT Purchased: 50,041,002

- Percentage of Total Supply Purchased: 5.0041%

- End Date: 2025-04-30

- Closing Price: $4.08494478

- 1,000,000 $TRADEBOT: $4,084,944.78

Summary

The projected prices for each buyback rate scenario demonstrate that higher buyback rates lead to significantly higher token prices, far exceeding the ATH observed in the real data. This analysis highlights the potential of TradeBot's Self-Healing Technology to create substantial value for token holders through strategic and sustained buy practices. The data shows that even a modest daily buyback rate can lead to noticeable price increases, while higher buyback rates can dramatically enhance the token's value.

Conclusion

TradeBot's self-healing technology offers a promising solution to the inherent volatility and risks of memecoins. By leveraging consistent revenue streams to buy tokens, TradeBot aims to stabilize and increase token value, creating a more equitable environment for investors. The detailed case studies of the $BRETT and $TRADEBOT tokens illustrate how this innovative approach can transform the memecoin landscape, reducing the zero-sum nature of these investments.

We invite new investors to join the TradeBot community and participate in building a sustainable and prosperous ecosystem.

Disclaimer

It is important to note that $TRADEBOT is a community-owned memecoin, relying heavily on the active participation and support of its community members. Inherently, $TRADEBOT possesses no intrinsic value and should be regarded primarily as an entertainment token. Prospective investors are encouraged to approach it with the understanding that its value is largely driven by community engagement and speculative interest.